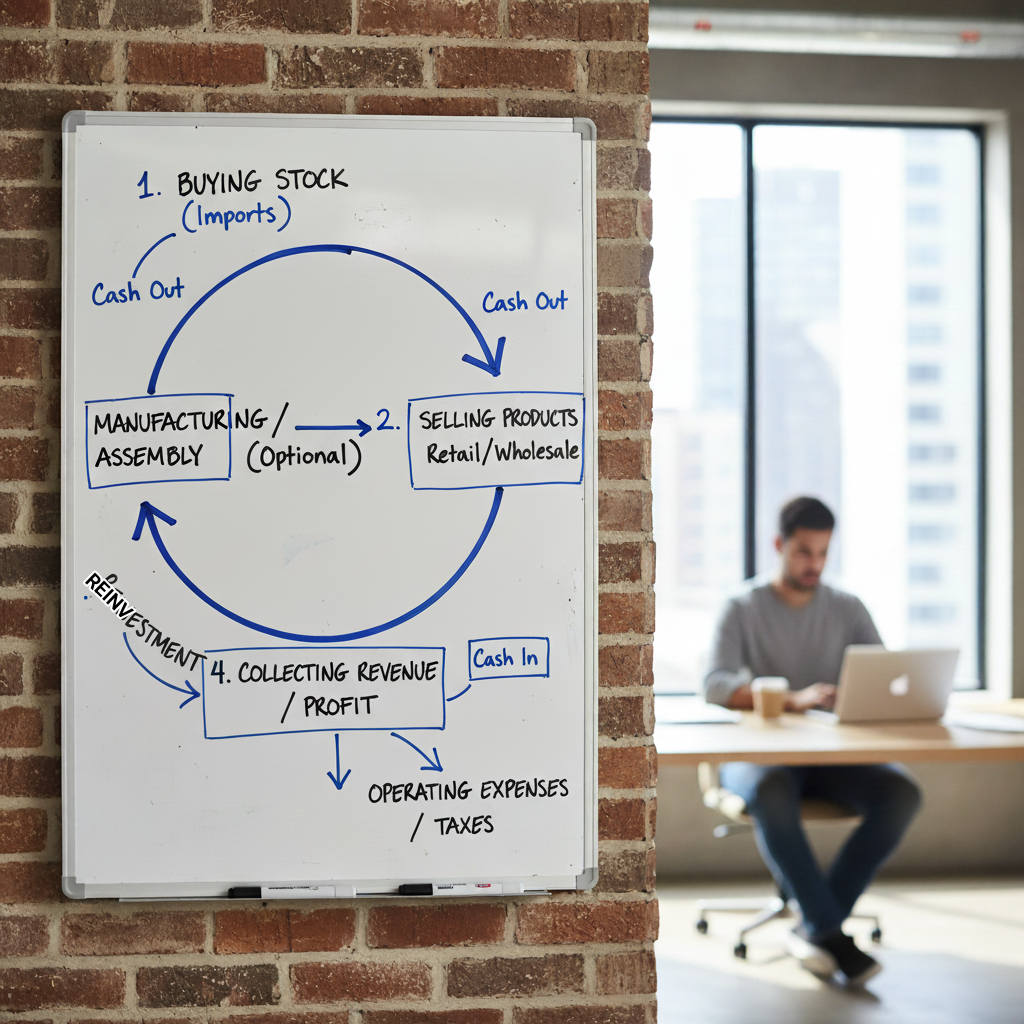

Many importers make sales but still struggle financially. This usually happens because profit and cash flow are confused. Cash flow determines whether you can restock, grow, or survive slow periods. This guide explains how small importers in Zambia can manage cash flow without complex accounting.

Step 1: Understand the Difference Between Profit and Cash

Profit is what remains after costs. Cash is what you physically have available.

Common mistake:

- Selling products on credit

- Spending cash before restocking

- Assuming sales equal stability

A profitable business can still fail due to poor cash flow.

Step 2: Plan Reorder Timing

Running out of stock stops cash flow completely.

Best practices:

- Track how long stock lasts

- Reorder before stock finishes

- Avoid waiting for zero inventory

Consistent stock keeps income predictable.

Step 3: Separate Business and Personal Money

Mixing funds hides real performance.

Simple separation:

- One mobile money account for business

- One for personal expenses

- Fixed withdrawal amounts

This protects working capital.

Step 4: Avoid Cash Flow Traps

Common traps include:

- Overbuying slow-moving products

- Offering excessive discounts

- Underpricing to chase volume

These decisions strain cash even when sales increase.

Step 5: Use Simple Tracking

You don’t need complex software.

Track:

- Stock purchased

- Sales collected

- Cash remaining

A simple notebook or spreadsheet is enough.

HVGadgets manages stock cycles carefully to ensure consistent availability without cash strain.