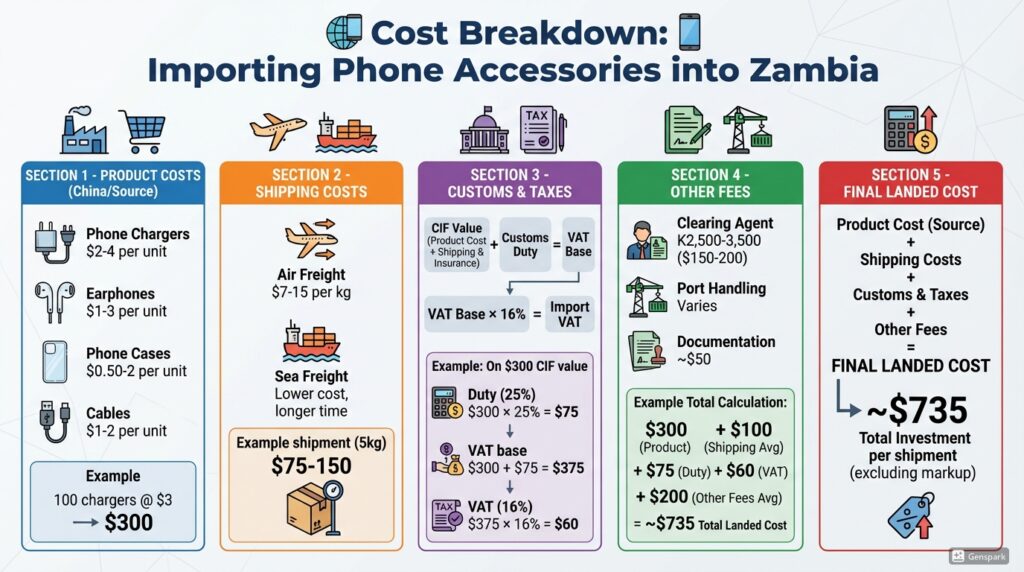

Many beginners think importing fails because products are expensive. In reality, most losses come from not understanding the total landed cost. Product price is only one part of the equation. This guide breaks down every cost involved when importing phone accessories into Zambia so beginners can price correctly and protect profits.

Step 1: Product Cost

This is the price paid to the supplier.

Example (phone chargers):

- China unit price: K10–K15

- Dubai unit price: K18–K22

Buying cheaper units does not always mean higher profit if shipping and delays are ignored.

Step 2: Shipping Costs

Shipping depends on weight, volume and urgency.

- Air freight: Faster, higher cost, best for testing

- Sea freight: Cheaper per unit, slower, best for bulk

Beginner mistake: choosing sea freight too early without proven demand.

Step 3: Customs & Clearing

Customs duties depend on:

- Product category

- Declared value

- Documentation accuracy

Clearing agents usually charge a fixed service fee. Always ask for a full breakdown upfront.

Step 4: Hidden Costs Beginners Forget

- Packaging

- Local transport

- Storage

- Currency exchange fees

Ignoring these eats into profit margins.

Step 5: Final Landed Cost Example

If one charger costs K12 to buy:

- Shipping: K6

- Clearing & fees: K4

Final cost: K22

Selling at K35–K40 allows sustainable margin.

HVGadgets calculates full landed cost before importing to ensure pricing remains profitable.